Key Message

The FHFA’s proposed capital rule is poised to have significant repercussions on the housing finance system. The rule’s bank-like capital requirements would raise mortgage rates by 15-20 basis points while the GSEs are in conservatorship and by 30-35 basis points if they are privatized. This increase results from the higher capital costs and reduced capital relief from credit risk transfers (CRTs). Consequently, the GSEs would need to hold more capital, leading to decreased incentives to offload credit risk and potentially increasing their exposure to riskier loans.

The proposed rule also undermines the GSEs' role in providing market stability during economic stress, as evidenced during the COVID-19 pandemic. By increasing capital requirements and reducing CRT utilization, the rule may limit the GSEs’ ability to support the mortgage market effectively. The authors recommend adopting a more tailored capital framework that aligns with the GSEs' specific risk profiles and promotes a balanced and resilient housing finance system.

In its proposed capital rule for Fannie Mae and Freddie Mac, the Federal Housing Finance Agency offers a framework intended to allow the government-sponsored enterprises to be released from the heightened oversight of conservatorship or a consent order in a strong enough position to remain viable even under severe economic stress. This is more difficult than it sounds, however. It is not simply a matter of determining how much capital the enterprises hold, but also what kind of capital, how their capital requirements change through the economic cycle, and how the requirements affect the incentives of the enterprises and other mortgage market participants. It is not about picking a single number, but creating a set of requirements and incentives for the GSEs that ultimately leads to a more stable housing finance system.

To do this, the FHFA has proposed a capital framework much like that required in the banking system (FHFA 2020a). It includes risk-based requirements that depend on the amount and kind of risk the enterprises take on, and a leverage ratio that provides a backstop, so that no matter how much or little risk the GSEs assume, they must always hold capital equal to at least some percentage of their overall assets.

In this paper we summarize and then critique this complex effort, concluding that the FHFA’s proposal misapplies the bank capital regime in a way that would ultimately take the GSEs and the housing finance system in the wrong direction, unnecessarily leading to higher mortgage rates, riskier GSEs, and a less stable housing finance system.

Summary of the basic framework

In its risk-based capital requirements, the FHFA requires the GSEs to hold total capital equal to at least 8% of their risk-weighted assets. These assets are calculated using two methods, one based on a set of grids and formulas provided by the FHFA, and another based on the GSEs’ internal modeling. Each enterprise is required to hold 8% of the larger of the two results.

The enterprises must also maintain three additional capital buffers if they hope to distribute capital to shareholders or bonus payments to their employees. The first is a so-called stress buffer, which is the additional capital needed to remain a going concern under stress scenarios. The second is a systemic stability buffer, in recognition that their failure would cause widespread damage to the financial system. And the third is a countercyclical buffer, which is to be built up in good economic times and drawn down in times of stress.

According to the FHFA’s calculations, as of September 30, 2019, the risk-based capital requirements proposed would have required the GSEs together to hold $234 billion in total capital: $135 billion given the risk in their portfolios and $99 billion for the three capital buffers. The FHFA set the initial countercyclical buffer to zero, making it difficult to gauge how illustrative this period will be of the total capital the GSEs will need to hold over time.

In addition to meeting the risk-based capital requirements, the enterprises must also comply with a 4% leverage ratio, which means holding capital equal to 4% of their total assets irrespective of how much or little risk they hold. According to the FHFA’s calculation, in order to meet this requirement as of September 30, 2019, the GSEs together would have needed to hold $243 billion in capital. As the higher of the two capital requirements, it would have been binding at the time.

As the risk-based capital requirements and leverage ratio together determine the enterprises’ minimum capital level, each enterprise will typically operate well above that level to avoid being out of compliance due to fluctuations in market conditions, the risk they are taking on, or their capital levels. Private mortgage insurers typically maintain capital levels as much as 10% higher than those required of them by the FHFA. If the GSEs were to follow the private mortgage insurers’ practice, they would have held $267 billion in capital under the FHFA’s capital framework as of September 30, 2019.

Under the proposed capital rule, then, the GSEs would have maintained capital equal to 4.4% of the GSEs’ just over $6 trillion in total assets, which include $5.5 trillion in single- and multifamily debt that they guaranteed at the time along with other assets.1 This is comparable to the capital commercial banks are required to hold on their mortgage loans.

Summary of the key features

Within this basic capital framework, four additional features deserve particular attention: the capital relief provided for transferring credit risk; the countercyclical loan-to-value adjustment; the risk-weighted floor on mortgage credit risk exposure; and the capital charge for cross-holding mortgage-based securities.

Credit Risk Transfer

The FHFA proposes to substantially reduce the capital relief the GSEs receive for transferring credit risk to private investors through the credit risk transfer market. Over the last few years, the GSEs have transferred about twothirds of their overall single-family credit risk into the CRT market, which takes approximately one-fourth of all the mortgage credit risk originated in the market today.2 The FHFA believes the current capital treatment of CRTs does not adequately cover uncollateralized counterparty risk, the risk of loss after a CRT deal expires, and the risk of loss due to the inability of the GSEs to allocate capital across reference pools. When using their own equity capital, the GSEs can allocate capital to cover losses across their entire portfolio. When using CRT to cover losses, however, the GSEs can use only capital provided by investors in that CRT, leaving them unable to apply unused risk coverage from another CRT and thus vulnerable to a loss. The FHFA also proposes imposing a 10% risk-weighted floor on retained CRT exposure, irrespective of how remote that risk might be.

Countercyclical Loan-to-Value Adjustment

As in the FHFA’s 2018 capital proposal, the regulator proposes to require the GSEs to mark to market the loanto-value ratios on the loans they guarantee in order to determine the capital they must hold. As LTVs fall in hot housing markets and rise in cold ones, this creates a procyclical dynamic in the rule, with enterprises releasing capital and expanding lending in hot markets and building capital and contracting lending in stressed ones. To reduce these procyclical swings, the FHFA proposes to reduce the downward adjustments to mark-to-market LTVs whenever real house prices rise more than 5% above national historical trends, and to reduce upward adjustments whenever real house prices fall more than 5% below national historical trends.

Risk-Weighted Floor

As part of its risk-based capital requirement, the FHFA would impose a risk-weighted floor of 15% for all mortgage risk exposure, in effect raising the capital required for the loans that would require less on an economic basis. This would help distribute the overall increase in capital more evenly across the credit risk spectrum but reduce the incentive to guarantee these lower-risk loans.

Cross-Holding of MBS

Today, each enterprise guarantees mortgage-backed securities issued by the other enterprise, in order to ensure the fungibility of Fannie’s and Freddie’s issuance and thus the functioning of the uniform MBS or single security. Under the proposed rule, each enterprise would be required to hold capital against any MBS guaranteed by the other enterprise, to cover the counterparty risk in the absence of a full faith and guarantee from the U.S. Treasury.

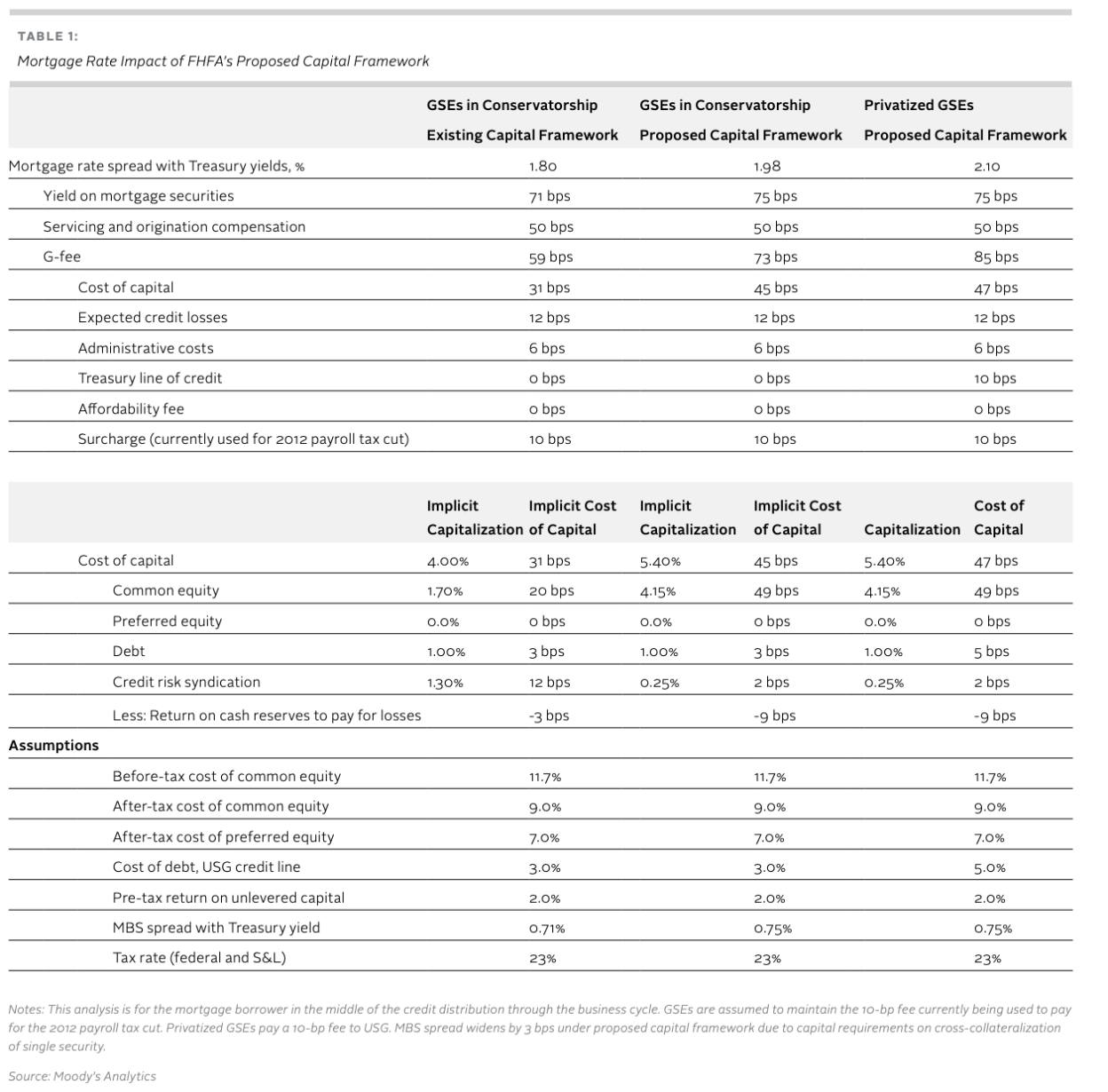

Mortgage Rate Impact of FHFA’s Proposed Capital Framework

Mortgage Rates

The proposed rule would result in higher mortgage rates. We estimate that under normal economic conditions GSE borrowers would see rates increase by an average of 15 to 20 basis points while the GSEs remain in conservatorship and 30 to 35 basis points if they were released from conservatorship, though the GSEs could require some borrowers to bear more or less of the increase than others (see Table 1).3

Mortgage rates will rise under the FHFA’s proposed capital rule primarily because it requires the GSEs to hold more capital.4 The cost of that capital could change modestly, as the GSEs’ current pricing is already consistent with the returns equity investors earn on investments in private, systemically important financial institutions. One caveat is that CRTs provide a somewhat cheaper source of capital given the tax advantages of the debt used by CRT investors to purchase the CRTs. Since CRTs will be used significantly less under the proposed rule, this will increase the GSEs’ cost of capital. The higher capital required for the GSEs to cross-collateralize the other’s MBS will put additional upward pressure on mortgage costs, by reducing liquidity and increasing yields.

If the GSEs are released from conservatorship, rates would increase still more under the proposed framework, at least eventually. Privatization through administrative action could take many forms, but it is likely that the U.S. Treasury would provide a limited contractual backstop through the Senior Preferred Stock Purchase Agreements. As private institutions, the GSEs would need to hold a bit more capital than they do in conservatorship to ensure they do not run afoul of their regulatory requirements, and their cost of debt would increase, as they would no longer be able to borrow at close to the low cost of the U.S. Treasury. The GSEs would also need to pay a fee to the Treasury for the backstop it provides to them. All told, we estimate that the rate on a 30-year fixed rate mortgage guaranteed by the GSEs would eventually increase by 30 to 35 basis points more than under the current capital framework in conservatorship.

Mortgage Origination Share

The GSEs have maintained one-third to two-thirds of total single-family mortgage originations over the past two decades (see Chart). Their share of the origination market hit its low point during the height of the housing bubble in the mid-2000s, when private-label securitization dominated the market. Their share then hit its peak in the late 2000s as the housing market collapsed, the private-label securities market disappeared, and bank portfolio lenders struggled to survive and rebuild their capital. With the recovery of the market and portfolio lending, their market share has since fallen back to about 45% of originations, similar to their level prior to the housing bubble and bust.

Under the FHFA’s proposed capital rule, we estimate that the privatized GSEs would lose 10 to 14 percentage points of origination market share on average through the business cycle. Approximately two-thirds of that would go to portfolio lenders, whole loan buyers, and perhaps some private-label securitization, as pricing for the lowest-risk loans converge with that offered in those markets. And about one-third of the loss would be from their higher-risk loans going to the Federal Housing Administration, particularly borrowers whose incomes are below 80% of average median income and first-time homebuyers with incomes of less than 100% of AMI (see Table 2).5

Mortgage Rate Impact of Changes Due to FHFA’s Proposed Capital Framework (2020Q2, %)

The GSEs’ share of the loan origination market would decline to near one-third, as low as it has been since the height of the housing bubble when the private-label securitization market was at its apex.

Credit Risk

While the FHFA’s new capital framework will reduce the GSEs’ share of the loan origination market, it will meaningfully increase their credit risk exposure. Early this year, the GSEs were holding on to little of the credit risk in the mortgages being originated. During the height of the financial crisis, they were taking close to onehalf of the credit risk in originations. The dramatic drop is due largely to the GSEs’ aggressive use of the credit risk transfer market to off-load their credit risk to private investors.

The FHFA’s proposed capital rule will change this, reducing significantly the GSEs’ incentive to off-load their credit risk. According to the FHFA’s estimates, the additional capital charges and 10% risk-weight floor together cut the relief the GSEs get for CRT today roughly in half (see Table 3).6 More impactfully, though, capital requirements of 4% or greater would make CRT non-economic to transact in all but a few economic conditions, ultimately pushing the GSEs to retain 85% to 90% of their risk.7

The leverage ratio compounds this incentive to hold more risk generally. Once released from conservatorship, the GSEs will presumably seek to maximize their shareholder return. To do this under the proposed capital rule, when their risk-based capital requirement falls below the 4% leverage ratio, they will need to increase the risk they assume to achieve the higher returns consistent with the higher 4% capital level.

To increase the risk they assume, they would need to shift their business towards more high-risk lending. Competition with FHA will limit their ability to move into that space, however, forcing them to consider alternative markets for high-risk loans, precisely as they did in the run-up to the Great Recession.

GSEs’ Risk Transfers Under FHFA’s Proposed Capital Framework

The pursuit of “bank-like” capital

With this proposal, the FHFA is following through on the plan for GSE reform it released with the Treasury Department in September 2019. A centerpiece of that plan is its commitment to force Fannie and Freddie to compete on what it takes to be equal footing with others in the mortgage market, in part by requiring them to hold the same amount of capital as banks. It appears the FHFA has indeed worked backward from that objective here, beginning with the capital the banks are required to hold and setting the GSEs’ capital rules so that they need to hold approximately the same amount of capital, regardless of the risks the GSEs are taking.

This is a misguided way to set capital levels. As we have demonstrated elsewhere, the GSEs take on much less risk in the aggregate than banks and thus should hold less capital. The GSEs bear only the credit risk on the mortgage loans they guarantee, whereas bank lenders also shoulder the interest rate risk and significant funding risk on these loans.8 This difference derives from the GSEs’ government backstop, which allows the enterprises to issue MBS in which investors take on the interest rate risk.9 If the GSEs and banks are indeed required to hold the same level of capital for the same risks—which should be the objective here—the GSEs would be required to hold less capital than banks.10

Though large banks designated too systemically important to fail also have a government backstop, the nature of that backstop will become clear only during a crisis. The support thus does not provide them the same market advantage that it provides the GSEs, where MBS investors know that they are protected from even the most severe credit losses. The FHFA’s commitment to replicating much of the banks’ capital regime also appears to be behind its diminishing the viability of credit risk transfers for the GSEs, precisely as regulators have done for banks. However, it makes little sense to import the bank regulators’ approach here. In their capital treatment of credit risk transactions, banking regulators were addressing the precrisis practice of some banks using such transactions for accounting relief without actually transferring the credit risk, setting up wholly owned special purpose vehicles to take risk that would ultimately come back to the bank in a time of stress. None of the GSEs’ transactions to date carry this risk: All of them are with third parties and many of them are fully funded by cash drawn down to cover the credit risk transferred. Though it would be appropriate to reduce the GSEs’ capital relief for the kinds of transactions that have concerned bank regulators, it is difficult to see the justification reducing it for all CRTs. By unnecessarily impairing the viability of CRTs, the FHFA’s capital rule undermines the ability of the GSEs to distribute their credit risk, thus increasing their capital needs and the burden on taxpayers while they are in conservatorship.

As the FHFA’s rule will likely provide a roadmap for changes to the PMIERS capital rule for private mortgage insurers, the ability of PMIs to off-load their credit risk to investors through the insurance-linked note market could also be diminished. The PMIs have aggressively expanded their use of the ILN market in recent years to more effectively manage their credit risk. A smaller and more expensive ILN market will increase the risk, capital needs and thus costs of private mortgage insurance.

The costs of this approach

The FHFA’s attempt to shoehorn the GSEs into a bank-like capital regime would exact a heavy cost on the mortgage market. It would drive up mortgage rates, increase the incentive the GSEs have to take on credit risk, and decrease their incentive to off-load that risk. In effect, it would take us to a more expensive, excessively capitalized version of the housing finance system we had prior to the financial crisis.

This would be a marked step back from where the system stands today, in which the GSEs have increasingly assumed the role of market intermediaries, connecting primary and secondary market participants and offloading the interest rate risk and lion’s share of the credit risk they assume along the way. And it is the opposite direction from which we should be heading with further reforms. We should be building upon the model of GSEs as intermediaries while expanding access to credit, not pushing all of the risk in the system back into the GSEs and driving up the cost of mortgage credit.

The cross-guarantee charge also threatens to undermine one of the other critical reforms of recent years, the single security. The capital charge will likely force the GSEs to charge a fee for issuing uniform mortgage-backed securities with a mix of loans guaranteed by both enterprises. As investors view the securities issued by the enterprises differently, they will demand and price them differently, undermining their fungibility and with it the long-term viability of the single security. As we have discussed elsewhere, this will reduce liquidity of the mortgage market, drive up the cost of mortgages, and create a barrier to additional housing finance reforms.

And then the smaller GSE footprint that would follow from the proposed capital rule would present challenges as well. Most important, it would limit the ability of the government to support the market in times of stress. The virus has made clear how critical that support can be, with the segments of the market outside of the reach of government support all but shutting down in March and slow to recover since. By shifting a meaningful amount of the GSEs’ current market share into these segments, FHFA will be increasing the amount of the mortgage market subject to these dramatic swings in liquidity, increasing the instability of the system overall and decreasing the ability of policymakers to manage that instability.

All in all, then, the capital rule proposed would reverse the recent trend towards a more liquid, stable and diversified housing finance system.

It is also worth noting that the rule proposed would create a considerable headwind for the GSEs’ path out conservatorship, an often mentioned objective of FHFA and the Trump administration. With the GSEs losing market share to the FHA on one hand and banks on the other, it is unclear what mix of business would be left to meet their capital and shareholder return requirements, particularly given the limits in their charter on the kinds of assets they can invest in and the requirement that they provide loans to low- and moderate-income borrowers at “reasonable economic returns that may be less than the returns earned on other activities.”11 Together these policy constraints cast into doubt the GSEs’ ability to earn the returns necessary to attract and retain shareholders, even setting aside the considerable political uncertainty around their release from conservatorship.

A better approach

Instead of adopting its proposed capital rule, the FHFA should simply adopt the rule proposed in 2018, which is close to what the GSEs use implicitly today, with adjustments to reduce the procyclicality. The GSEs would still need to satisfy a substantial risk-based capital requirement and leverage ratio, but as they are already doing so implicitly, their guarantee fees and mortgage rates would remain unchanged from where they are today.

The GSEs’ current guarantee fees imply capitalization of close to 3%, which is more than adequate to ensure that they remain going concerns under severe stressed economic scenarios. This would have been sufficient for them to remain going concerns through the financial crisis, and considerably more than would be needed today given their mix of business (see Table 4). The GSEs’ current loans are largely fully documented, plain vanilla, long-term, pre-payable, fixed rate loans to borrowers with strong credit characteristics, a far cry from the mix of Alt-A and subprime loans they backed in the housing bubble prior to the financial crisis.

The stress tests taken by the GSEs last year confirm that their current implicit capitalization is more than adequate to ensure their safety and soundness. Like systemically important banks, the GSEs must determine the level of capital they would need to remain going concerns after suffering losses similar in severity to the financial crisis of a decade ago. Recent stress-testing on the loans the GSEs currently guarantee has determined their severely adverse stress losses to be close to 1% even assuming they are not allowed to use their deferred tax assets, leaving plenty of room for a going concern buffer while staying within a 3% capital level.12

The FHFA’s proposed capital rule has not landed on a higher required capitalization for the GSEs because its analysis suggests that more capital would have been needed for them to remain viable, or because it is solving for a larger drop in house prices or greater sustained unemployment than we saw in the financial crisis. It has landed on these higher numbers because they include credit risk-invariant considerations that overwhelm its own analysis of the credit risk involved. This point is worth repeating: Its own analysis of the credit risk involved should land it on the risk-based capital levels we are recommending. By choosing much higher levels, it is distorting the incentives of the GSEs and creating unnecessary cost in the system.

In addition to grounding the capital rule in credit risk, the FHFA should change its approach to mitigating the procyclicality of the 2018 proposal. By relying on national house price trends, the countercyclical adjustments proposed may well do more harm than good. House price trends tend to vary considerably by region, with geographically constrained urban centers with fast-growing, high-paying industries often showing greater house price growth than less densely populated areas with slower-growing, lower-paying industries. Tying capital requirements, and thus mortgage cost and availability, to national house price trends will result in overly tight lending standards in some parts of the country and overly easy standards in other parts.

To address the procyclicality of the 2018 rule, the FHFA should regionalize its countercyclical adjustments so that capital flows more freely in markets that are cooling and less freely in those that are heating up. It should also push the GSEs to do more, not less, CRT through the cycle, as reducing the credit risk they hold will reduce whatever procyclical effect might be left in the capital requirements.

Residential Mortgage Loan Realized Losses ($ bil)

Conclusion

The capital rule is one of the more important policies the FHFA will implement, affecting how much many families pay for a mortgage, how stable our housing finance system is through the economic cycle, and how well our mortgage market as a whole serves the nation. Unfortunately, by conflating the capital needs of the GSEs with those of banks, the FHFA has proposed a regime that falls short across each of those dimensions, leaving us with unnecessarily high mortgage rates, too much risk concentrated in the GSEs, and a system that is more risky and less stable than the one we have today.

1. The other assets include the GSEs’ derivatives exposure, repo transactions, and various off-balance sheet exposures.

2. All told, the federal government and thus taxpayers are currently taking on about half of the credit risk being originated in the mortgage market, with almost all of that through Ginnie Mae. Fannie and Freddie are off-loading nearly all of their credit risk on new originations to private sources of capital, which are currently taking the other half of the credit risk being originated. For historical context, taxpayers are taking on the same amount of credit risk today, at least implicitly, as they were in the early 2000s.

3. The range of the mortgage rate impact is based on a plausible range for the various underlying assumptions needed to determine the impact.

4. The mortgage rate impacts shown in Table 1 assume that the 4% leverage ratio plus the 10% buffer to ensure the GSEs do not fall below the ratio is the binding capital constraint.

5. We assume here that FHA does not respond by tightening their underwriting or raising their premiums, as they do not appear to be poised to make any such adjustments. If they do, however, the overall government footprint in the market will shrink, exacerbating the volatility we discuss elsewhere in the paper.

6. See page 25 of FHFA’s webinar presentation of June 4, 2020 (2020b). In its analysis, the FHFA compares the relief the GSEs would get for a stylized CRT under the 2018 rule to what they would get under the new proposal. The GSEs receive capital relief today consistent with what they would receive under the 2018 rule and the example is consistent with relief for CRT more broadly, so the analysis shows nicely how the proposal compares broadly to today.

7. Setting binding capital requirements at 4% or greater would put their capital level well above their underlying net credit risk exposure, which today stands at less than 2%, per page 28 of the FHFA’s estimates referenced above. So long as the requirements are above the underlying risk, there is very little incentive for the GSEs to further reduce the aggregate risk through CRT or mortgage insurance.

8. Banks’ 5% capitalization is consistent with the 50% risk-weight in bank Basel regulations put on their single family residential mortgage lending and a 10% overall capitalization.

9. The GSEs should of course compensate taxpayers for this support. Determining the appropriate level of compensation is difficult given the remoteness of the risk the government is taking and the absence of a private market to determine its cost, but the most prominent legislative reform effort put this fee at 10 basis points. This is precisely the amount by which the GSEs’ current guarantee fee already exceeds the level of capitalization for systemically important financial institutions to cover the payroll tax. And that suggests their capitalization and pricing are already in line with what is needed to cover the government’s backstop

10. The only way to level the playing field through capital may well be to set this fee not at a level to reflect the risk involved, but at whatever level would be needed to remove the market advantage the backstop affords. However, rather than leveling the playing field in the sense of making all participants hold the same capital for the same risks, this would unlevel it simply to give competitors a fighting chance against more efficient competitors.

11. See Housing and Economic Recovery Act of 2008

12. This is consistent with the Congressional Budget Office’s estimate of the federal government’s fair-value subsidy to the GSEs.

Federal Housing Finance Agency. 2020. Enterprise Regulatory Capital Framework: Notice of Proposed Rulemaking. Washington, DC: Federal Housing Finance Agency. (2020a)

Federal Housing Finance Agency. 2020. Re-Proposed Rule on Enterprise Capital: Overview of Proposed Rulemaking. Washington, DC: Federal Housing Finance Agency. (2020b)