Key Message

The authors argue that while the CARES Act and Federal Reserve interventions have stabilized mortgage markets, the potential of mortgage refinancing as a stimulus channel is not fully realized. The barriers include a higher-than-expected spread between mortgage and Treasury rates and tightened underwriting standards. The report proposes a new Home Affordable Refinance Program (HARP 3.0) to streamline the refinancing process without requiring income verification. This would lower mortgage payments, reduce default risks, and stimulate consumer spending.

Implementing HARP 3.0 could lead to substantial economic benefits, including reducing mortgage rates by an average of 173 basis points, saving consumers approximately $76 billion annually, and increasing consumption by about $53 billion per year. The program would also disproportionately benefit homeowners of color, who face greater challenges in accessing refinancing. The authors emphasize that such a policy could provide immediate economic relief and long-term stability, making it a crucial tool in the broader economic recovery strategy.

Introduction

The COVID-19 crisis has pushed unemployment to its highest level since the Great Depression, and, at the time of this writing, the economy is in a deep recession. In past financial downturns, the mortgage market has worked to counter downturns, with lower interest rates passed through to households through lower mortgage rates, acting as an important countercyclical force. This paper documents the current impact of legislative and monetary policy on mortgage markets, explaining their countercyclical limitations and offers additional policy responses.

Anticipating the impact of government mandates shutting down business and limiting social interactions, Congress implemented the CARES Act and its successor which provide $3 trillion in stimulus/relief; the Treasury issued about $1.5 Trillion in new debt securities during March and April of 2020; and the Federal Reserve purchased an almost equal amount on the open market. In addition, the Fed has opened up facilities to become a lender of last resort in areas where it had not previously participated, including corporate and municipal bonds. The Federal Funds rate is now near zero and the 10-year Treasury is at record lows; and in March and April of 2020, the Fed purchased almost $300 billion of agency MBS each month, considerably more than the total amount of agency securities originated that month. As of September, 2020 the Federal Reserve owns close to $2 trillion of agency MBS out the approximately $7 trillion outstanding (Federal Reserve Bank of New York 2020).

The CARES Act specifically requires mortgage lenders to implement a forbearance program to enable borrowers to postpone mortgage payments. The forbearance program was appropriately put into place in response to the pandemic and the increases in unemployed and furloughed workers. Nonetheless, as we document, this has resulted in a tightening of lending underwriting standards and an increase in the mortgage to treasury rate spread. Both limit the potential positive impact of low interest rates as a countercyclical measure.

While forbearance was a necessary response to the COVID-19 crisis, there is an important channel for stimulus that is not being fully exploited: the mortgage refinance channel. The channel could benefit consumers and investors and the overall economy in two ways—first consumers benefit through lowering payments by lowering rates for both home purchase and refinance mortgage loans. Di Maggio et al. (2017) demonstrate the importance of the lower rate channel by examining the behavior of adjustable rates borrowers whose mortgage payments fell during the Global Financial Crisis. Second, reducing payments would also lower the risk endemic to mortgages: Schmeiser and Gross (2016) show that modifications where the principal and interest payments were reduced re-defaulted at a lower rate. And evidence is universal that the Home Affordable Refinance Program, which allowed for lenders to refinance mortgages in a streamlined fashion, reducing borrower payments, reduced default risk. (See for example, Abel and Fuster (2018), Karamon, McManus, Zhu (2016), Mitman (2016), Zhu (2014)). More recently, Girardi and Willen (2020) argue that the reduction in default risk owing to reduced payments would allow for the system to refinance mortgages, provide some cash to borrowers, and keep the default risk constant.

Macroeconomic conditions should now be particularly ripe for borrowers to take advantage of refinancing their mortgages. Ten-year Treasury notes—usually the benchmark rate for mortgages—are at post World War II lows. Mortgage rates have followed suit. Simultaneously, home equity is at its all-time high in nominal terms, and the average loan-to-value ratio among current homeowners is at its lowest level since 1990. In this environment, households should be able to refinance to take advantage of the potential for less onerous safe loans with their healthy equity cushion.

Yet while mortgage rates have fallen to all time loans, data show them to be around 40 basis points higher than we would expect, given the low yield on 10-year Treasuries. Refinancing at lower rates would benefit both consumers and investors via lower default rates, but increased stringency in underwriting prevents these mutual gains.

These two barriers to fully taking advantage of the countercyclical potential in refinancing mortgages—the higher than average spread over Treasuries and increased stringency in mortgage underwriting—could be mitigated through policy. We propose a Home Affordable Refinance Program (HARP) 3.0. HARP 1.0 and 2.0 were implemented as a response to the Global Finance Crisis. HARP allowed households who were current on their mortgages, but with low or negative home equity, to take advantage of low mortgage rates without need for additional mortgage insurance. Before HARP, borrowers who had proven themselves to be excellent credit risks were unable to exercise the refinance—or call—option because of very high LTVs—often well in excess of 100 percent-- that were the result of falling house prices.

When borrowers refinanced their loan under HARP 1.0 and 2.0, they lowered their payments to those commensurate with then current rates. They also decreased their probability of default as a result of the lower payments. When these programs were instituted, there was a recognition that investors would lose value (due to prepayments), but also that they willingly purchased a security with an embedded call option. Recognizing this, the HARP 1.0 program allowed for a streamlined refinance for many borrowers and HARP 2.0 further expanded the number of eligible borrowers and substantially reduced the friction to refinance. In particular, LTV maximums were eliminated, eligible borrowers were able to refinance their mortgage without obtaining an appraisal, rep-and-warrant relief was granted to lenders, so the borrower was not at the mercy of their original servicer, and for borrowers with an original LTV over 80% and mortgage insurance in place, the mortgage insurance was permitted to transfer to the new loan.

We now find ourselves in a similar situation to that during the Great Financial Crisis. Like then, the economy is performing poorly and the unemployment rate is high, but the COVID induced recession has one important difference for the mortgage market. At this point, very few borrowers find themselves in houses that are worth less than their mortgages. Not only have people paid down their mortgages from 10 years ago, but house price increases have been robust (despite that fact that mortgage credit had been, by historical standards, tight1 ), meaning that even households who bought with a low downpayment loan a year ago likely have some equity in their house at the moment.

The newly unemployed do have two things in common with those from eight years ago with negative equity. One, they faced an exogenous shock that placed them in a precarious financial position. And two, they will be less likely to default if they receive payment relief. This paper therefore contemplates what a HARP 3.0—one that allows for a rate and term refinance without requiring income verification—might imply for the mortgage market, the housing market and the broader economy.

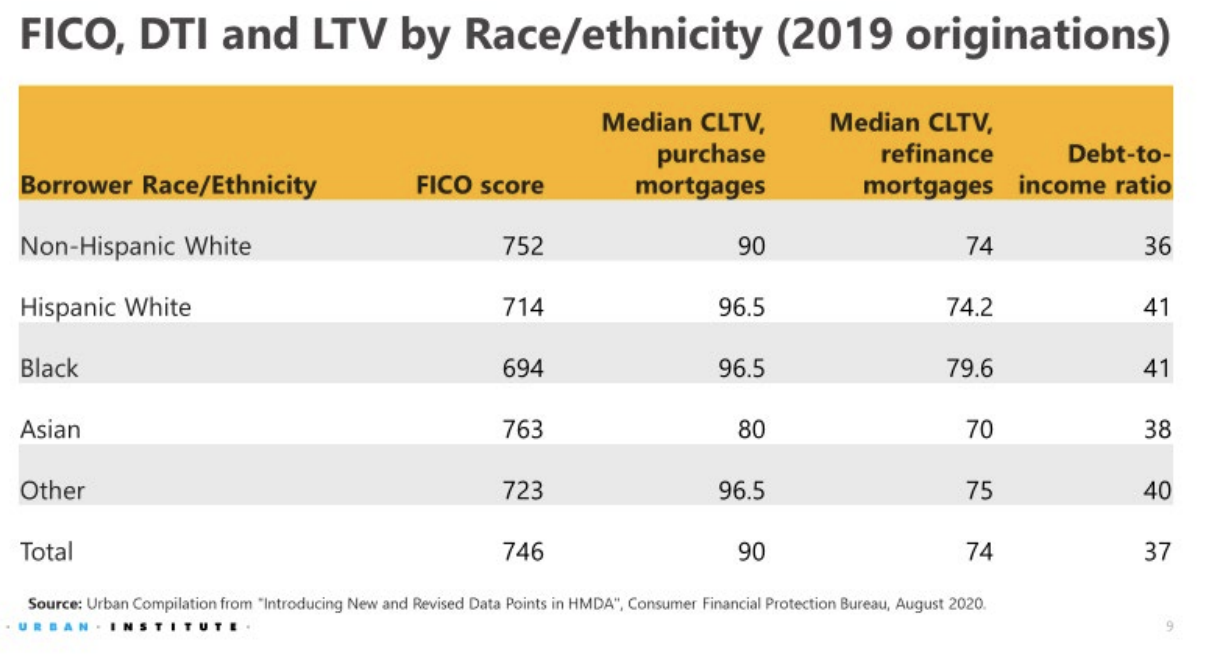

It is important to note that the benefits of a streamlined refinance program will accrue disproportionately to homeowners of color. Table 1 shows that Black and Hispanic borrowers have much lower credit scores, higher combined loan-to-value ratios and higher debt-to-income ratios than their non-Hispanic white counterparts. For example, the median credit score for a non-Hispanic white borrower in 2019 was 752, versus 714 for a Hispanic white borrower and 694 for a black borrower. And we will show later in this paper that COVID-19 has contributed to a dramatic tightening of credit, particularly in refinance loans, making homeowners of color less likely to be able to refinance in the current environment.

The remainder of this paper is in three sections. The first section contains our literature review, demonstrating that mortgage interest rates are an important transmission mechanism for monetary policy; lower rates increase economic activity and spur consumer spending.

1 See Urban Institute’s Housing Credit Availability Index, https://www.urban.org/policy-centers/housing-finance-policy-center/proj…, accessed May 15, 2020.

Table 1: FICO, DTI, LTV by race/ethnicity (2019 originations)

The second section discusses how current programs are working and why mortgage refinance is not currently working as well as it could as a channel for relief or as a stimulus. In particular, we will document how mortgage rate spreads have widened relative to 10-year Treasury notes, and present evidence about the composition of mortgage spreads, with particular attention to servicing costs in a world of mortgage forbearance.

In the third section, we discuss and quantify the benefits of a streamlined refinance policy in the current environment. In particular, we focus on two implications. First we show on how the new/old policy of HARP 3.0, which would allow people to refinance their mortgages without income verification, would lower the probability of default. We look at the impact of this on market participants, including borrowers, Government Sponsored Enterprises (GSEs), investors in credit risk transfers (CRT), who, in exchange for a premium, share in first loss positions on mortgages, and, of course, investors in mortgage backed securities.

Second, we show a streamlined refinance program will be highly stimulative. We will provide partial equilibrium estimates of the impact of HARP 3.0 on consumption, relying on marginal propensities to consume out of interest payment reductions estimated in previous literature. (A word of caution here—the pandemic may lower marginal propensities to consume, as consumers may value precautionary savings more during a pandemic).

1. Literature Review

A number of recent papers have shown that mortgage interest rates are an important transmission mechanism between monetary policy and consumer spending. The idea is straightforward: if households’ debt service payments fall, non-housing disposable income rises, and so too does consumption. Because mortgages are long term, one could look at a reduction in mortgage payments (either via a fall in an adjustable rate mortgage rate or a refinancing from one fixed rate mortgage into another with a lower rate) as an increase in permanent income. These papers have also shown that the mortgage channel is more powerful than others for stimulating consumer spending, and that the mortgage channel could be streamlined to become even more effective.

Di Maggio, Kermani, Keys, Tomasz Piskorski, Ramcharan, Seru, and Yao (2017) showed how a falling interest rate environment affected adjustable rate borrowers’ spending behavior during the global financial crisis. They found that borrowers who benefitted from an interest rate reset had a marginal propensity to consume out of mortgage savings of about .7; they also found the impact to be heterogeneous, with lower income borrowers having a higher MPC than higher income borrowers.

Cloyne, Ferreira and Surico (2020) found that homeowners with mortgages in the US and UK were the only households whose consumption was influenced by interest rate cuts—neither renters not homeowners without mortgages changed their consumption in response to interest rate changes. This strongly suggests that the adjustable rate mortgage channel (in the UK and to some extent in the US) and the mortgage refinance channel (in the US) are the most important mechanism for effective monetary policy.

Similarly, Di Maggio, Kermani and Palmer (2020) found that the Federal Reserve’s policy of quantitative easing had its most profound impact through the mortgage channel. In particular, they found that QE had important impacts on mortgage interest rates and therefore, by extension, refinance volumes. They also showed that those households that did refinance also increased their consumption of durable goods by 12 percent. The sources of funds for these durable goods payments included the money saved from refinancing and equity extraction.

Chakraborty, Goldstein, and MacKinley (2020) compared the impacts of the Federal Reserve’s MBS and Treasury purchases on spending. Surprisingly, the Treasury purchases seemed to have no impact on spending, while the MBS purchased did.

There is also substantial support in the literature for the effectiveness of streamlined refinancing as a tool to lower default rates. Work by Mitman (2016) demonstrates the welfare improving effects of the Home Affordable Refinance Program (HARP), a program that substantially streamlined refinancings and allowed underwater borrowers to refinance their loans beginning in 2012. He finds a one percentage point decrease in default rates for HARP mortgages owing to the reduction in payments arising from lower interest rates. Abel and Fuster (2018) find that the HARP program contributed to a 40 percent reduction in the default rates of mortgage debts, 25 percent reduction in the default rates on other debt. Karamon, McManus and Zhu (2016) find that HARP contributed to a 48-62 percent reduction in Freddie Mac default rates. Zhu (2014) reported a similar decline.

Finally Agarwal, Amromin, Chomsisengphet, Landvoigt, Tomasz Piskorski, Seru, and Yao (2020) showed that frictions in the refinancing market created by the HARP program prevented it from being even more effective than it was. In particular, they argue that a more streamlined program could have had take-up rates and annual savings of as much as 20 percent more than were actually realized.

2. How Current Programs Are Working in the COVID-19 Environment

Forbearance is a crucial program for preventing the unemployment surge from leading to disastrous increases in defaults and enabling borrowers to maintain needed consumption despite the loss of income. Low interest rates and Fed purchases of agency MBS have stabilized mortgage markets. Nonetheless, interest rate declines are not reaching homebuyers or homeowners in full. While interest rates have fallen considerably, mortgage rates remain high. There are two main obstacles to borrowing or refinancing in the current environment, the fact that primary mortgage rates are high relative to Treasury rates and the fact that the credit box has tightened. Both limit the countercyclical benefit of low interest rates to the economy.

High Primary Mortgage Rates Relative To Treasury Rates

Primary rates remain stubbornly high relative to secondary mortgage rates. Fed intervention has stabilized the secondary mortgage market, producing a large rate decline in this market. This has not translated into primary mortgage rates. First, we look at the sequence of events that generated this.

As the threat of Covid-19 disrupted the financial system and generated extreme volatility in the Treasury market, the Fed, on March 3, 2020, put into place a 50 basis points emergency cut in the Fed funds rate to maintain the liquidity and functioning of credit markets. In response to this rate cut and market pressure, 10-year Treasury rates declined by 100bps to 0.54% - an all-time low—on March 9. However, the markets for mortgages and mortgage-backed securities (MBS) were still showing unprecedented stress, as reflected by the increase in the spread between 10-year Treasuries and MBS to 160 bps, a level not seen in over a decade. On March 17, the Fed announced it would initiate an asset purchase program, pledging to purchase $700 billion in Treasury securities and, to deal with the still unprecedentedly spread between 10-year Treasuries and Agency MBS, the purchase of $200 billion in Agency MBS. Nonetheless the gap between 10-year Treasuries and agency MBS spiked to 170 basis point on March 19. In response, on March 23, the Fed pledged to expand its agency MBS purchases without limits to ensure market stability, stating they would buy agency MBS and Treasuries “in the amounts needed to support smooth market functioning and effective transmission of monetary policy to broader financial markets and the economy”. During the following week, the Fed purchased $50 billion and $75 billion of Agency MBS and Treasury securities every day. During the last 2 weeks of March 2020, the Fed purchased $292 billion of agency MBS, their largest single month of purchases to date. This represented 178% of total supply. In response to the Fed’s very aggressive backstop, the secondary market spread between MBS and 10-year Treasuries dropped to 80 basis points, near the historic average, by March 27, 2020. Very aggressive Fed intervention was also necessary in April, when they purchased $295 billion. In May through September of 2020 purchases tapered off to around $100 billion in each month, still high by historical standards. As a result of this aggressive intervention, secondary spreads have stabilized at or below historical levels.

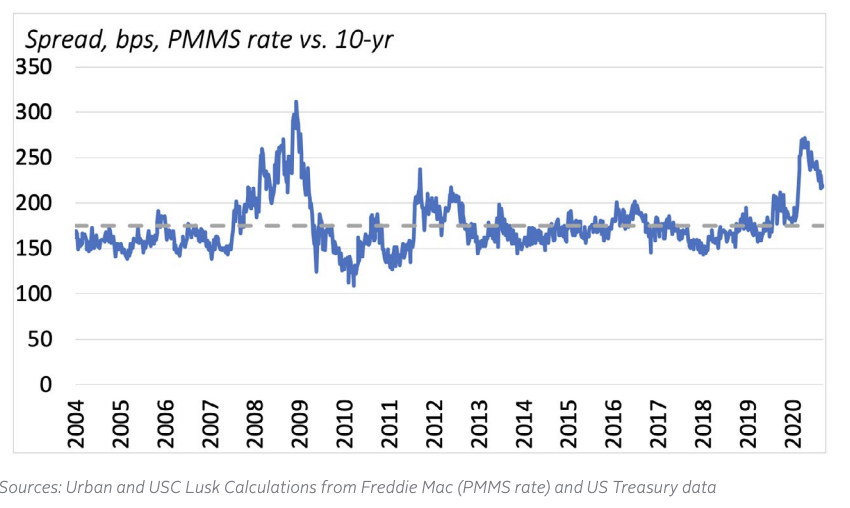

Figure 1: The Primary Mortgage Rate is High Relative to Treasury Rates

Nonetheless, despite the fact that the secondary mortgage rate declined considerably, the primary mortgage rate has remained stubbornly high, as shown in Figure 1. That is from January 2, 2020 to September 17, 2020, 10-year Treasury rates declined by 118 bps (from 1.88% to 0.70%), while primary mortgage rates declined by only 85 bps (from 3.72% to 2.87%).

As of September 17, the spread between the primary mortgage rate and the 10-year Treasury stands at 217 basis points, 42 basis points wider than its historical average. It was as wide as 265 bps at the peak in April, 90 bps wider than its historical average, and it has declined 48 bps since. Why are these spreads so wide? Some amount of this, about 10 basis points, can be explained by the fact that mortgage servicing rights (MSRs) are trading so poorly. The sharp drop in MSR values reflect both the servicing advancing issues discussed below, as well as the high cost of servicing delinquent loans versus performing loans. Most of the loans in forbearance will require the servicer to work with the borrower to explain post forbearance choices, and some fraction of these loans will go delinquent; servicing delinquent loans is much more costly than servicing performing loans.2 Some amount of the wide spread between the PMMS rate and the 10-year treasury can be explained by very number of high refinance applications coupled with slower processing of many loans in the midst of the pandemic, with mortgage originators working from home. As lenders have been able to operate more efficiently in this environment, the spread has come down substantially since the April. But the fact remains that those borrowers who are able to refinance would be able to do so at lower rates (and hence spend even more) if primary mortgage rates retained their historical relationships to secondary mortgage rates and to Treasuries. Moreover, borrowers who don’t refinance because they don’t save enough would find it economic to do so. In addition, if the refinance were streamlined as we discuss the slower processing of requests could be significantly lowered.

We argue in this paper that streamlining the refinance process makes sense, yet current policies are going in the wrong direction. The FHFA has enacted a 50 basis point upfront surcharge (loan level pricing adjustment) on GSE refinances, which goes into effect in December, 2020. This will likely increase the mortgage rate by about 12.5 bps, making it more costly to refinance.

Contraction in Credit Availability

The second obstacle to borrowing at lower rates is that the credit box has narrowed. There are two factors initially contributing to this narrowing: servicer liquidity concerns as a result of servicer advancing responsibilities and the inability or high cost of selling loans that have gone into forbearance. The first factor has receded in importance, while the second has increased. Let’s look at each in turn.

As unemployment claims hit record levels in March and April, it was clear that many homeowners would not be able to make their mortgage payments. The GSEs had long established policies of what to do after presidentially declared natural disasters. Given there had been a declaration in early March of a national emergency, the GSEs announced on March 18 that borrowers were eligible for the relief typically given following natural disasters.3 The relief came in the form of forbearance of up to 12 months and suspension of foreclosures for 60 days. Borrowers needed to request forbearance stating a hardship, but no documentation was required. During forbearance, homeowners did not need to pay on the mortgage, and they would not be reported to the credit bureaus as delinquent. Nonetheless the standards for approval were not clear, there were some restrictions, e.g., the loan needed to be current, and most importantly there was lack of clarity about how the payments were to be made up after the forbearance period.

The CARES Act (March 27) somewhat strengthened and clarified the forbearance program. For example, the requirement that the loan be current was eliminated. And the forbearance did not need to be approved; the borrower need only attest he had a COVID-19 related hardship. If the borrower asked for the forbearance, it had to be granted for up to 6 months with an option to the borrower to extend another 6 months.

While Congress appropriately allowed borrower forbearance, they did not consider the burden on the servicers to advance principal and interest (P&I) payments and real estate taxes and insurance (T&I) payments. In addition, for FHA loans servicers are responsible for the mortgage insurance premium; for GSE loans they are responsible for the private mortgage insurance premium plus the guarantee fees. When the implications of this became clear, Ginnie Mae used its emergency powers to set up the PTAP (pass-through assistance program); this program allows servicers to borrow to meet their P&I advance requirements, albeit at a penalty rate. However, servicers are still responsible for T&I payments, as well as the mortgage insurance premium. The GSE agreed to advance P&I payments after 4 months, but again servicers are responsible for T&I payments, private mortgage insurance payments and guarantee fees.

While these expenses are ultimately reimbursable, it strains the liquidity position of many non-bank servicers. The logical response: the originator/servicer does want to make a mortgage to a borrower who has an elevated probability of defaulting. A recent paper by Goodman, Parrott, Ryan and Zandi showed that, based on a 10 percent forbearance rate and 4 months of forbearance, this could run $33 billion for all servicers, $18 billion for non-bank servicers. Higher forbearance rates and longer forbearance periods will increase the numbers substantially. Many servicers were initially expecting forbearance rates of 25 percent; and were very concerned about the implications for their liquidity.

The forbearance numbers have come in much lower. The Mortgage Bankers Association showed a peak forbearance rate of 8.6 percent in May 2020; but servicers estimate that a quarter to a third of the borrowers requesting forbearance continued to make their mortgage payments. This forbearance rate declined quickly, falling to around 7 percent in the mid-to-late September period and declining further to 6.3 percent in early October as the first 6 months of forbearance ran out for many borrowers, and they opted not to extend. The number does vary much across channels, as the forbearance rate is 4.0 percent for GSE loans, 8.3 percent for government loans and 10.1 percent for loans in bank portfolios and private label securities. Initially, servicer concerns about liquidity stress tightened the credit box, but it did not widen as these concerns receded.

During the summer and fall of 2020, the single largest contributor to the tightening of credit was the treatment of mortgages originated under GSE or FHA standards with the expectation of being sold to the GSEs (FHA), but who ask for forbearance before the mortgages are delivered to the GSEs (FHA). The spirit of the CARES Act would seem to cover these mortgages, but FHFA and the GSEs have decided that they will only purchase a subset of these loans (cash-out refis are excluded) and with delivery fees of 7% (with a 2% discount for first time homebuyers). While the delivery fee of 7% may seem punitive, it is well below the price charged in the “scratch and dent” market where the discount it typically 20%. Many lenders are unwilling to accept the risk of losing the 7% on the mortgage (or the 20% in the case of the cash-out refis) and have tightened their credit box. Similarly, FHA requires the servicer to absorb 20 percent of the eventual loss if the loan misses two payments in the first two years. The originators have responded to this by shortening the period between origination and sales. This period was 2-4 weeks prior to the introduction of these charges, many originators have shortened to one week. Even so, this has had an adverse impact on access to credit, as originators impose overlays as a result of these charges (Goodman and Neal, 2020).

It is clear that the GSEs do not want to buy loans that have been sitting on a bank’s balance sheet for months when the borrower requests forbearance, but the argument that this is a problem for newly originated loans seems weak. There are various proposed bills in the House of Representatives that would reverse this policy and require the GSEs and FHA to purchase all mortgages that otherwise would be eligible for sale but for the forbearance. However, nothing has passed.

2 See Mortgage Bankers Association data in Chart 4 of this FDIC report. https://www.fdic.gov/bank/analytical/quarterly/2019-vol13-4/fdic-v13n4- 3q2019-article3.pdf Wachter, Susan M. “Illiquidity and Insolvency in Mortgage Markets,” comment on paper by Kim, You Suk, Steven M. Laufer, Karen Pence, Richard Stanton, and Nancy Wallace (2018). “Liquidity Crises in the Mortgage Market.” Brookings Papers on Economic Activity, Spring 2018: p. 347-428. 3 See https://www.fanniemae.com/portal/media/corporate-news/2020/covid-homeow…)

Tightening of the Credit Box

The credit tightening pressure arising from servicing advances compounded by the reality that loans that go into forbearance before sale can be sold only at a deep discount (or with lender recourse) has caused many originators to increase their credit overlays over and above those within the GSE, FHA, or VA credit boxes. A few examples from press reports in the wake of the pandemic: both Wells Fargo, the largest mortgage originator, and US Bank, also a very large originator, increased their minimum credit score to 680. Flagstar Bank increased their minimum credit score of 640. Navy Federal and Better.com stopped offering FHA loans, Better.com also raised their minimum LTV on jumbo loans to 80 LTV. JP Morgan Chase tightened the most: they have increased their minimum FICO score to 700 and now require an 80 LTV for all except existing customers with a mortgage and certain affordable housing programs. Not all lenders have tightened their credit box, but many have.

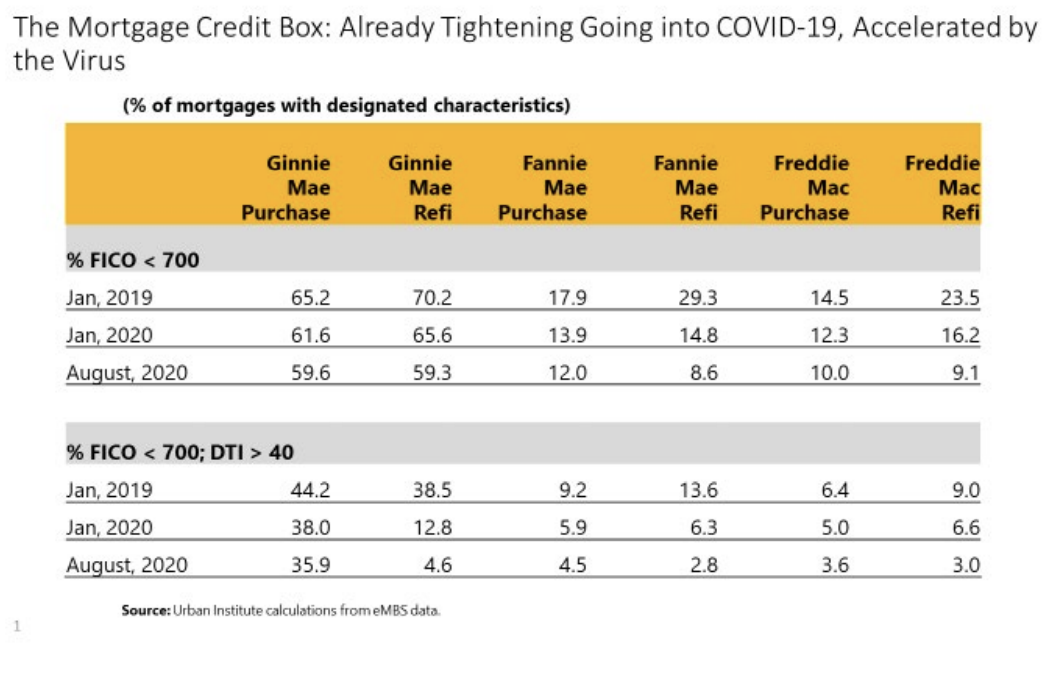

Table 2 shows that the credit box was already tightening going in 2020, and it has been exacerbated by COVID -19. This applies to both Ginnie Mae loans as well as GSE loans. Moreover, the tightening in the refinance credit box, particularly in 2020, has been far more dramatic than in the purchase box. The table shows that 29.3 percent of Fannie Mae refi borrowers had FICOs less than 700 in January of 2019, declining to 14.8 percent in January of 2020 and 8.6 percent in August of 2020. The decline in the purchase arena is less dramatic: 17.9 percent of Fannie Mae purchase borrowers had FICO scores less than 700 in January of 2019., it was 13.9% in January of 2020 and 12.0 percent in August of 2020.

Table 2

If we look at the percent of borrowers who had FICOs less than 700 and debt-to-income ratios less than 40, we again see a far more pronounced decline in refi volume than in purchase volume. For Fannie Mae refis, 13.6% of the mortgages were in this category, versus 6.3 percent in January 2020, and 2.8 percent in August of 2020. The purchase declines are more muted.

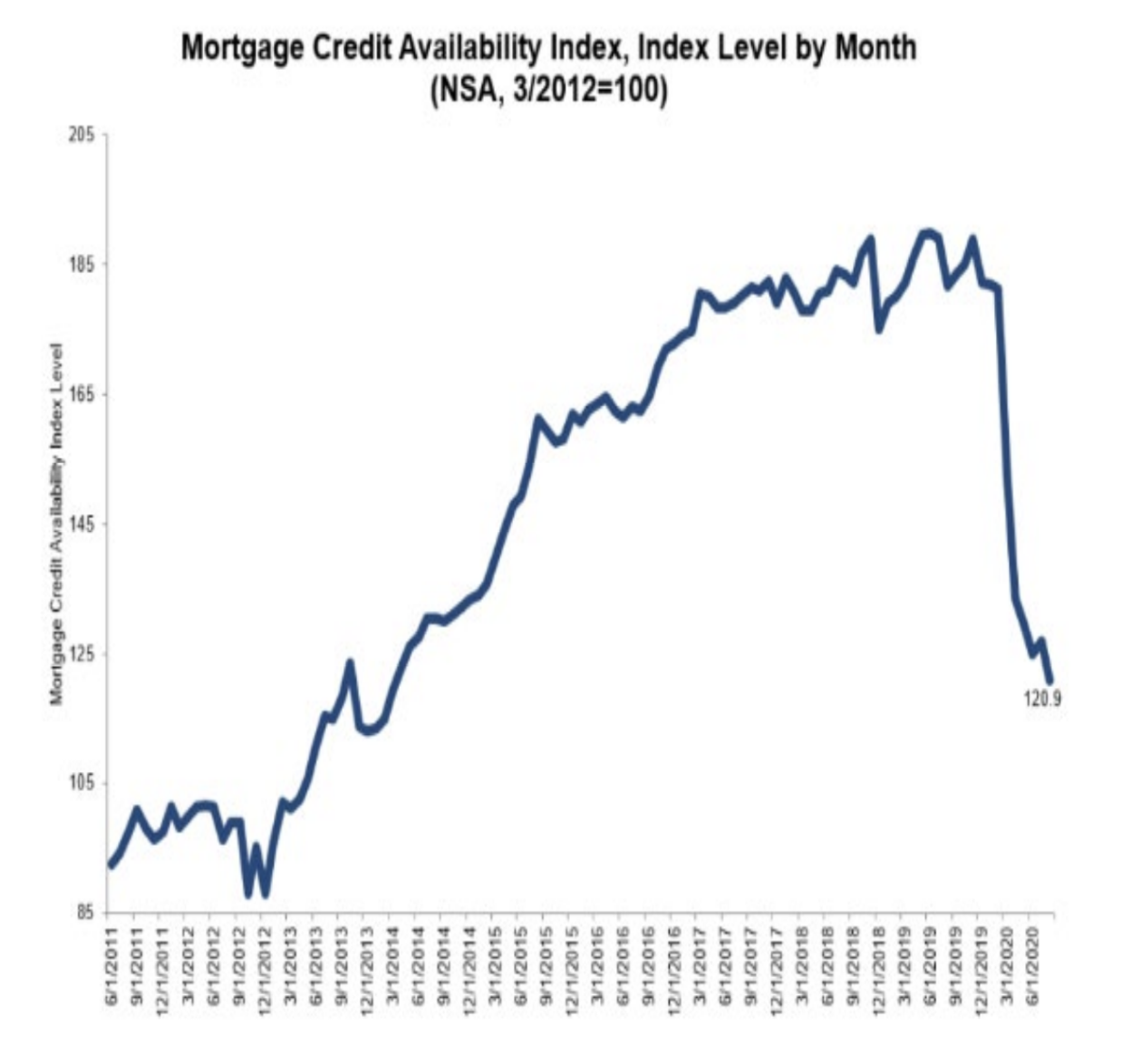

This is supported by the Mortgage Banker’s Association’s Credit Availability Index, which measures credit availability based on underwriting guidelines. The August data, released in early September shows the over the past six months, the credit availability index has declined by 33%, putting it back to 2014 levels. This reflects a 59% decline in credit availability for jumbo product, 19% for government loans and 23% for conventional conforming credit.

Figure 2: MBA Mortgage Credit Availability Index

Other Factors Inhibiting Refinancing

It is important to realize that the tightening of the credit box does not fully measure constraints on borrowing for refinancing. A few additional obstacles that should be noted. While in order to do a rate/term refinancing from a Fannie Mae mortgage to another Fannie Mae mortgage, or from a Freddie Mac mortgage to another Freddie Mac mortgage, the GSEs do not require an appraisal, an appraisal is required for a Fannie to Freddie refinance or visa versa. It is also required for most cash-out refinancings. In some cases, Fannie and Freddie are allowing exterior only appraisals, but in many instances they are requiring interior appraisals as well. It is very difficult to complete an interior appraisal in this COVID-19 environment.

In addition to the appraisal issue, all refinancings require verification of employment. This can be hard to obtain even for those who are employed, with so many human resources professional working from home. Fannie and Freddie have permitted additional flexibility here, allowing e-mails from the employer, as well as pay stubs and bank statements. For the unemployed, even those with assets, verification of employment is, of course, impossible.

Finally, the GSEs are asking their lenders to verify continuity of income. That is, the GSEs are asking their lenders to do due diligence to ensure that any disruption to a borrower’s employment or self-employment and/ or income due to COVID-19 is not expected to impact their ability to repay the loans. This is very vague, but it places an additional burden on lenders (Goodman and Klein, 2020).

The forbearance program, appropriately put into place in response to the pandemic, has resulted in a tightening of lending standards and an increase in the mortgage to treasury rate spread. Both limit the potential positive impact of low interest rates as a countercyclical measure. Moreover, if the economic fallout of the pandemic continues or worsens, the utility of forbearance as a policy response will lessen. The forbearance period is a maximum of a year, and many borrowers are already more than six months into it. If the recession deepens, or just drags on for a long period of time, deliquencies are likely to rise, with potential spikes in foreclosures as well. The policy of a HARP 3.0 that we suggest below delivers additional stimulus to the economy now while it helps to protect against rising defaults.

We do recognize that forbearance will also protect consumption by providing a modest stimulus. We estimate that the total dollars that homeowners will save over the next 4 months is approximately $20 billion. However, this must be paid back, with the principal and interest payments most likely to be tacked on to the end of the mortgage. A stimulus is also coming from refinances under the current regime, but not as large as its potential, which we discuss next.

3. Policy Prescription: A New HARP

A new HARP would have two major benefits in this environment: it would lower default rates and would provide a substantial stimulus to the economy. We look at each in turn.

3A. Benefit #1: A New Harp Reduces the Default Rate

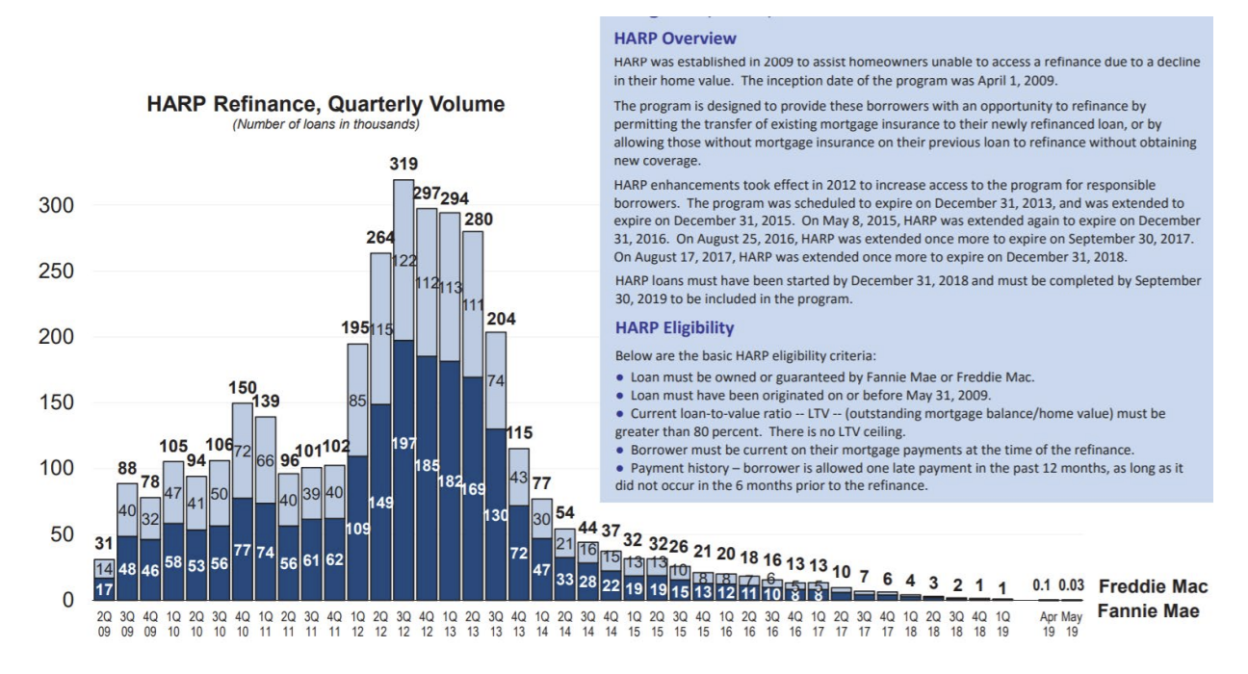

During the Great Recession the barrier to refinancing was lack of equity in the house due to the 30% decline in house prices. Many borrowers found themselves paying 5 or 6 % on mortgages rather than refinancing into 4% mortgages because their mark-to-market LTV was above 100%. After much reluctance, FHFA and the GSEs adopted the Home Affordable Refinance Program (HARP), a program that allowed refinancing even with LTVs well above 100%. More than 3.5 million borrowers took advantage of this program. As paper after paper in our literature review, discussed in section 1, shows, this program resulted in a considerable decrease in default rates due to the reduction in payments. Figure 3, from an FHFA report of HARP, shows HARP volume over time.

Figure 3

Today the issue is not loss of equity and high LTVs, but rather loss of jobs and income. To be eligible for a new GSE mortgage one needs to go through a rigorous verification of employment (some originators are re-verifying employment the day of the closing) and generally have a debt to income ratio (backend) of less than 45%. This strikes us as suboptimal lending policy, if the goal of the GSEs and FHA is to minimize credit risk to themselves—if they automatically refinanced the mortgages they already guarantee into a lower interest, lower payment mortgage, they will reduce their credit exposure. After all, every aspect of the loan they are guaranteeing remains constant, except for the lower payment, which past literature has shown reduces default. Parallel to the HARP 2.0 program that waived LTV tests and appraisals, a HARP-COVID-19 (or HARP 3.0) program would waive all employment and income tests for no cash-out refinances. While some banks may adapt similar programs for non-agency and FHA loans, we do our analysis assuming applicability only to such loans.

We argue that a HARP 3.0 would give borrowers who are facing difficulty refinancing the opportunity to do so, and would reduce frictions for borrowers who can currently refinance under the current credit box.

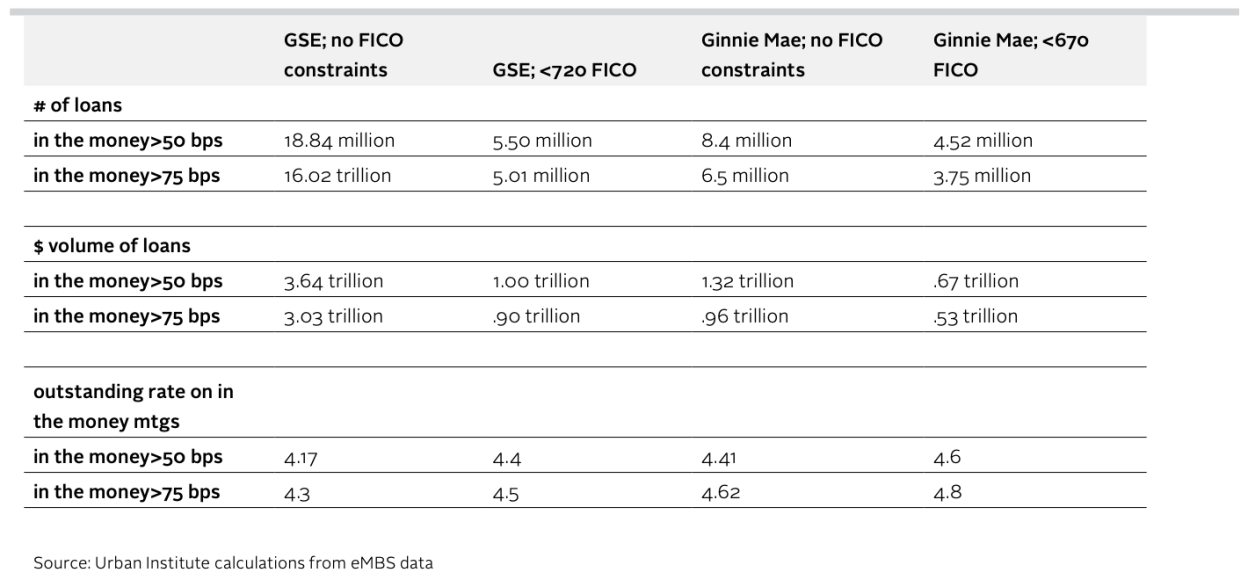

Implications for Borrowers Who Would Face Difficulties Refinancing

The forbearance program has helped alleviate some immediate stress in the system; it is currently assisting approximately 900 million GSE borrowers and 1,000,000 Ginnie Mae (FHA/VA/RHS) borrowers. However, as shown in Table 3 (below), there are 18 million GSE borrowers and another 8.4 million Government borrowers who are at least 50 basis points in the money (using current mortgage rates, which does not consider a further reduction if the process was further streamlined). It is hard to determine what percentage of borrowers would have difficulties in refinancing (because that would involve running all current borrowers through a mortgage underwriting algorithm and knowing the cut-off that is used). We thus do a first order estimate by assuming those with GSE loans and FICO scores of less than 720 and those with government loans and FICO scores of less than 670 will have difficulty getting their mortgages refinanced. When we limit the universe of HARP 3.0 to borrowers who are at least 50 bps in the money and would have difficulties in refinancing, we estimate there are 5.5 million GSE borrowers and another 4.5 million Ginnie Mae borrowers (See table 3) who could benefit from a new HARP program. If three million of these borrowers were to refinance under the program and lower their mortgage rate from 4.45% to 2.5%, the resulting savings would be about $2600 per year for each homeowner (assuming an average loan size of $200,000) and an aggregate savings of $7.8 Billion per year or about $62 billion over the life of the mortgage with an assumed average life of 8 years. By lowering monthly payments, a HARP 3.0 could substantially lower the default rate on these mortgages.

Table 3: Quantifying the Impact

Table 3 shows that those 10 million mortgages have a mortgage balance of $1.67 trillion. The analysis in this section is conservative, assuming that HARP 3.0 reaches just 3 million mortgages, 2.5 million GSE borrowers and 0.5 million FHA borrowers, with mortgage balances of $600 billion and an interest rate savings of 1.95%. We believe this is the lower bound estimate of the impact of such a policy: the take-up rate for GSE and Ginnie Mae loans could be higher, and banks and private label lenders might on their own initiate no-cost refinances.

Implications for the GSES: Do Refinances that Pay Off Credit Risk Transfers Increase Overall Agency Costs?

In the aftermath of the Great Financial Crisis, one concern about HARP was that the GSEs themselves owned a large mortgage portfolio and they would face a loss if these premium mortgages (i.e., mortgages whose rates were higher than market rates) prepaid.4 But the GSEs now have much smaller portfolios. Instead, they have issued credit risk transfer (CRT) bonds that would need to be replaced in the event of a refinance. CRTs share default risk with the agencies; the current cohorts of CRTs were issued at times when the mortgage market was not in distress. When loans refinance, the CRTs are paid off, and new loans will require new companion CRTs. Because these new instruments will be issued at a time of economic turbulence, they will likely be more expensive that the CRTs that they replace. We argue, however, that this cost will be small.

Currently the GSEs are paying approximately 200 bp in spread on bonds that represent 4% of remaining UPB. To replace that protection in today’s market on loans without employment or income verification would be significantly higher. Today’s prices for 2019 bonds are about $97, having recovered from a low of about $70 according to prices from VISTA Data Services. Given that the loans that benefit from a new HARP would be the higher risk loans, we conservatively use a price of $85 to determine how much the GSEs will have to pay for these loans removed from the CRT. Thus, relative to par, the GSEs are giving up a $15 implicit discount for credit protection. $15 on 4% of the UPB (the amount of bonds outstanding) translates to $600 million dollars per $100 billion of UPB that goes through a new HARP.

But the newly refinanced loans will have much lower expected losses arising from the reduction in mortgage payments. Our reading of the literature on HARP 2.0 implies to us that these losses would be about 20-40 percent lower. We take the base default rate to be 5%, the approximate default rate of fully documented Fannie Mae and Freddie Mac mortgages issued in 1999-2004 with FICOs less than 700. A reduction in default of 20 percent means one percentage point fewer mortgages default. Past research puts average loss severity of 40%,5 meaning that refinances will save the GSEs approximately $400 million per $100 billion. The net cost to the GSEs of a new HARP is hence approximately $200 million per $100 billion. Using the assumption of a takeup of 2.5 million GSE loans totaling $500 billion, our results would suggest a net cost to the GSEs of about $1 billion. If the take up is 100%, the cost would be roughly double that. Given the imprecision in these numbers, we view the net cost close to zero, but raise this issue out of concern that the CRT structures could be an impediment.

By contrast, the 2.5 million homeowners with GSE loans would be saving about $5.6 billion per year or $45 billion over the life of the mortgage, making the cost of paying off the CRT comparatively small. Ginnie Mae mortgages face no such issues. Note that the magnitudes of the benefits to consumers only considers those mortgages with current impediments to getting refinanced.

Implications for MBS Investors

The owners of MBS would, in the event of a very streamlined prepayment process, face a capital loss, as securities with price premiums would repay at par. One could assume that the loss would equal what homeowners gain or the $64 billion. However, that assumes the market prices each pool based on the exact characteristics of the underlying mortgages including the propensity to prepay and assumes that HARP 3 comes as a complete surprise. Because TBA market prices cheapest to deliver, that “par compression” is quite common and the market anticipates and has built in some likelihood of a new HARP program, the capital loss is likely to be much less. If the MBS trades at 1056, the loss is approximately $30 billion, not the $64 billion.

We would argue that this capital loss is largely considered a “sunk cost” and will not affect the pricing of new MBS going forward. It is possible that spreads might widen by a few basis points for a while but measuring such an effect is difficult and largely speculative.

5 See, for example, https://www.urban.org/sites/default/files/publication/102299/may-chartb…, pages 40-41 showing that historical loss severity for Fannie Mae and Freddie Mac fully documented fully amortizing mortgages has been approximately 40%, 6 http://www.mortgagenewsdaily.com/mbs/; accessed 9/22/2020.

3B. Benefit #2: A New Harp 3.0 Provides Substantial Stimulus

We turn now the potential impact of removing barriers to rate-and-term refinances on the broader economy. Our estimates in this version of the paper are rough but should give an order of magnitude effect of the importance of allowing borrowers access to lower interest rates. Note that for this section, to estimate the potential impact of the stimulus, we assume all GSE and Government mortgages in Table 3 that are more than 50 basis points in the money refinance. Unless refinancing happens automatically, this overstates take-up. However, we have included an assumption that the GSE and government mortgages must be 50 bps in the money at today’s rates, which are more than 40 bps higher than historical levels given the 10-year Treasury. The potential universe of in-the-money GSE and government mortgages could potentially be much larger than we have shown, and we have not considered loans on bank portfolios or those in the private label market, which make up about 30 percent of the market.

Our numbers in Table 3 indicate that 26.4 million borrowers are in the money by at least 50 basis points. The borrowers have a total balance of close to $5 trillion, and an average rate of 4.23% (4.17% on GSE mortgages, 4.41% on FHA mortgages.) Based on current refinance activity, if we assume $150 billion would be refinanced a month from September-December, 2020 without a streamlined program ($600 billion), this produces a refinancing pool of $4.4 trillion ($5 trillion minus the $600 billion that would be refinanced anyway). Thus in a world of 2.5 percent mortgage rates, the potential interest rate savings to consumers is

(4.23%-2.5%)*4.4 Trillion,

Or $76 billion per year. Because such a reduction would be long lasting, we may regard it as a change to permanent disposable income. We use the parameters in DiMaggio, et al. (2017) on the impact of reductions in adjustable rate mortgage payments on consumption to infer that the marginal propensity to consume out of mortgage interest payment reduction is about .7, which is consistent with the idea that the reduction is interest is equivalent to a change in permanent income. Thus, the change in consumption (0.7*$76) is approximately $53 billion per year.

A limitation of these calculations is they do not take into account that while consumer disposable income rises with falls in the mortgage rates they pay, investor income falls, which could undo some of this stimulus. But while the DiMaggio et al. (2017) paper shows that the average marginal propensity to consumer out of mortgage payment relief is .7, it is also highly heterogeneous: marginal propensities to consume are nearly zero at the top of the income distribution. However, agency mortgage backed securities are overwhelmingly in the hands of institutional investors, with commercial banks and the Federal Reserve being the largest holders, so the claw-back effect of reductions in investment income is likely minimal.

Conclusion

In response to the Covid-19 crisis, Congress and the Federal Reserve have taken unprecedented actions. Forbearance, called for by the CARES Act, keeps people in their homes despite job losses. As of September 2020, forbearance provided a one-time stimulus, as well as relief to approximately two million of America’s homeowners. In addition, Fed action has decreased 30-year fixed mortgage rates to all- time lows of 2.87%, down from more than 4% last year. Borrowing for home purchases has risen and refinancing is up substantially. Nonetheless, we show in this paper that mortgage rates are still elevated relative to 10-year Treasury rates, by over 40 basis points. Mortgage underwriting has also become far more restrictive. Forbearance has placed unusual stress on the mortgage industry, limiting the potential gains to borrowers from Fed actions.

We propose a remedy with the potential to unleash significantly more stimulus without cost to the taxpayer. In particular, a HARP 3.0 refinance program will enable the average borrower who is at least 50 bps in the money to lower mortgage interest payments by 173 basis points on average, or $76 billion in total; contributing to a total estimated additional stimulus per year of about $53 billion. This reform will also free up mortgage chain resources for home purchases, allow about 3 million borrowers who are unable to refinance due to tight underwriting standards to do so, and reduce the potential for burgeoning defaults if conditions worsen.

In this paper we have quantified both the relief and stimulus effects of policies that allow for easier refinances. We limit this analysis to the government back sector which is approximately three-quarters of the market. The results would be even larger (by about a third) if these policies were extended to private sector mortgages, i.e., those in bank portfolios or in private label securities, or if all mortgage products allowed for automatic pass through of lower rates. In addition, if rate reductions were automatic, the benefits of Fed policy would reach the market sooner rather than occurring slowly as the stock of mortgages turn over. How to reach mortgages not under direct government control and as well as how to redesign mortgage products to allow for automatic pass throughs of lower rates are topics that would benefit from further research and analysis.

Abel., Joshua and Andreas Fuster. 2018. “How Do Mortgage Refinances Affect Debt, Default, and Spending? Evidence from HARP”. Federal Reserve Bank of New York Staff Report 841, February, 2018. https://www. newyorkfed.org/medialibrary/media/research/staff_reports/sr841.pdf

Agarwal, S., Amromin, G., Chomsisengphet, S., Landvoigt, T., Piskorski, T., Seru, A., & Yao, V. (2015). Mortgage refinancing, consumer spending, and competition: Evidence from the home affordable refinancing program (No. w21512). National Bureau of Economic Research.

Chakraborty, I., Goldstein, I., & MacKinlay, A. (2020). Monetary stimulus and bank lending. Journal of Financial Economics, 136(1), 189-218.

Cloyne, J., Ferreira, C., & Surico, P. (2020). Monetary policy when households have debt: new evidence on the transmission mechanism. The Review of Economic Studies, 87(1), 102-129.

Di Maggio, M., Kermani, A., & Palmer, C. J. (2020). How quantitative easing works: Evidence on the refinancing channel. The Review of Economic Studies, 87(3), 1498-1528.

Di Maggio, M., Kermani, A., Keys, B. J., Piskorski, T., Ramcharan, R., Seru, A., & Yao, V. (2017). Interest rate pass-through: Mortgage rates, household consumption, and voluntary deleveraging. American Economic Review, 107(11), 3550-88.

Federal Reserve Bank of New York. 2020. “System Open Market Holding of Domestic Securities”.accessed August 26, 2020. https://www.newyorkfed.org/markets/soma/sysopen_accholdings

Gerardi, Kristopher, Lara Loewenstein, and Paul Willen. 2020. ”Evaluating the Benefits of a Streamlined Refinance Program. ”Federal Reserve Bank of Cleveland, Working Paper No. 20-21. https://doi.org/10.26509/ frbc-wp-202021.

Goodman, Laurie and Aaron Klein. 2020. “The Impact of the Coronavirus on Mortgage Refinancings”. Brooking Institution, April 13, 2020. https://www.brookings.edu/research/the-impact-of-the-coronavirus-onmortgage-refinancings/

Goodman, Laurie and Michael Neal. 2020. “A New Mortgage Penalty is Blocking Homeownership and Refinancing Opportunities for 255,000 Borrowers”, Urban Institute, July, 2020. https://www.urban.org/sites/ default/files/publication/102588/a-new-mortgage-penalty-is-blocking-homeownership-and-refinancingopportunities-for-255000-borrowers_0.pdf

Goodman, Laurie, Jim Parrott, Bob Ryan, and Mark Zandi. 2020. “The Mortgage Market has Caught the Virus”, May, 2020. https://www.urban.org/sites/default/files/publication/102225/the-mortgage-market-hascaught-the-virus.pdf

Karamon, Kadiri, Doug McManus, and Jun Zhu. 2016. “Refinance and Mortgage Default: A Regression Discontinuity Analysis,” The Journal of Real Estate Finance and Economics, 1–19.

Kim, You Suk, Steven M. Laufer, Karen Pence, Richard Stanton, and Nancy Wallace (2018). “Liquidity Crises in the Mortgage Market.” Brookings Papers on Economic Activity, Spring 2018: p. 347-428.

Mitman, Kurt 2016 “Macroeconomic Effects of Bankruptcy and Foreclosure Policies,” American Economic Review Volume 106, Number 8 pp 2219-2255

Schmeiser, Maximillan D. and Matthew B. Gross. 2016. “The Determinants of Subprime Mortgage Performance Following a Loan Modification”. J Real Estate Finance and Economics, Volume 52, Number 1.

Wachter, Susan M. “Illiquidity and Insolvency in Mortgage Markets,” comment on paper by Kim, You Suk, Steven M. Laufer, Karen Pence, Richard Stanton, and Nancy Wallace (2018). “Liquidity Crises in the Mortgage Market.” Brookings Papers on Economic Activity, Spring 2018: p. 347-428.

Zhu, Jun. 2014. “HARP Significantly Reduced Mortgage Default Rates”, Urban Institute. https://www.urban.org/sites/default/files/publication/22926/413220-HARP…